I wasn't overly familiar with the consequences of the revised Banking Code of Practice ("the Code  ") until I started receiving phone calls from brokers seeking guidance. The new code of practice

") until I started receiving phone calls from brokers seeking guidance. The new code of practice  , due to come into effect on the 1st of July, and one that takes various recommendations made by the Royal Commission

, due to come into effect on the 1st of July, and one that takes various recommendations made by the Royal Commission  into account, is in itself a reasonably sensible revision that seeks to make itself more human with more of a focus on consumer outcomes. However, it's not the code itself that presents issues for brokers, but rather the practical interpretations made by banks that potentially imposes additional risk on small broking businesses.

into account, is in itself a reasonably sensible revision that seeks to make itself more human with more of a focus on consumer outcomes. However, it's not the code itself that presents issues for brokers, but rather the practical interpretations made by banks that potentially imposes additional risk on small broking businesses.

While there are a number of amendments to the Code, it's the sections on guarantors and vulnerable consumers that seems to impact upon brokers, with the latter group taking center stage.

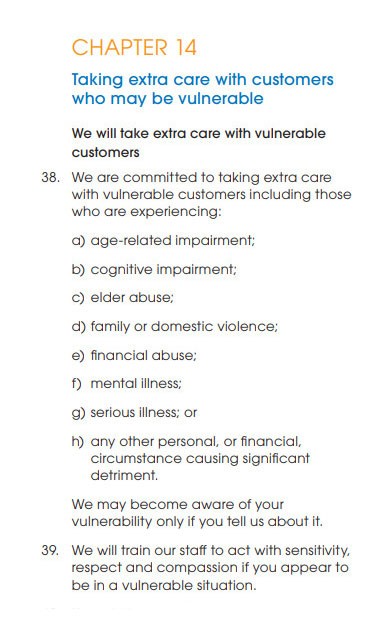

The code makes reference to "vulnerable customers" in Chapter 14, Section 38, - essentially stating that bankers will take extra care with vulnerable customers who are experiencing impairment, abuse, domestic violence, financial abuse, illness, or any other personal or financial circumstance causing significant detriment. The paragraph concludes by saying "[w]e may become aware of your vulnerability only if you tell us about it." Section 39 details, in brief, that staff will be trained to act with "sensitivity, respect, and compassion" if vulnerability is identified.

Pictured: The Code, Chapter 14, Section 38 and 39.

Various lender have made their own independent evaluation of that paragraph and are now issuing declarations to brokers asking that they identify and report these vulnerabilities. However, brokers are neither suitably trained to adequately assess vulnerable customers, nor are they covered by Professional Indemnity (PI) Insurance should their assessments or declarations fail to identify vulnerabilities. Of all the PI Insurers we spoke to all indicated that signing any declaration potentially exposes a business to significant financial risk.

Most banks require a declaration requiring that any vulnerability be reported to them. However, unless the vulnerabilities are declared directly to a broker any assessment is nothing more than guesswork. Not totally unlike our look at consumer mortgage fraud, what happens if a broker reports a vulnerability that doesn't exist, and will a broker be liable for financial consequences of such action? Should the nature of perceived abuse be reported upline to a bank, will that bank now inherit the responsibility of notifying relevant authorities or police? What happens when brokers get it wrong? Will consumers use a "vulnerability" as a get-out-of-jail card and then deflect the cause of their own financial hardship on a broker as a means of mitigating their inability to meet financial obligations? It's this uncertainty, uncharted, and immeasurable environment that leaves insurers unwilling to cover "social work" - well outside the scope of typical broking.

Mike Felton has made a video  where he details the MFAA's early response.

where he details the MFAA's early response.

The (only) problem with Mike's analysis is that he recommends brokers sign a declaration if they're comfortable making an assessment of vulnerability. When I was a police officer I once spent over 2-hours on the witness stand defending my actions in identifying an intoxicated individual... and I spent virtually every day of my policing life dealing with drunks. How could a broker with no formal training possibly defend themselves in the same manner? Even those brokers that are suitably trained - assuming we have some idea of what training might be sufficient - they'll still leave themselves liable for financial consequences if they cannot justify their actions. A clear set of guidelines with very well defined support systems must be in place if any burden is placed upon brokers to engage in activity for which they have no training.

The MFAA have said in a statement  that "The NCCP Act and the Banking Royal Commission have made it clear that the primary duty of brokers is to borrowers. According to interim legal advice taken by the MFAA, requiring brokers to report suspected financial abuse to lenders could be a breach of the broker/customer relationship, and may raise privacy issues. Given the standard imposed by the Code on lenders is that they may not know about financial vulnerability unless they are told by the customer themselves, it is inappropriate and impractical to impose a higher standard on brokers."

that "The NCCP Act and the Banking Royal Commission have made it clear that the primary duty of brokers is to borrowers. According to interim legal advice taken by the MFAA, requiring brokers to report suspected financial abuse to lenders could be a breach of the broker/customer relationship, and may raise privacy issues. Given the standard imposed by the Code on lenders is that they may not know about financial vulnerability unless they are told by the customer themselves, it is inappropriate and impractical to impose a higher standard on brokers."

The MFAA's immediate advice to refrain from signing any declaration means that on the 1st of July many brokers will be excluded from dealing with most of the major banks.

Various aggregators have made their own statement  with the common message being one to refrain from signing any declaration or attestations that may impose undue legal obligation or business risk.

with the common message being one to refrain from signing any declaration or attestations that may impose undue legal obligation or business risk.

For the banking system to implement their flawed interpretation of the code without first consulting the industry body that represents over 60% of all banking business is somewhat reckless. Historically, brokers have been the last line of defence against baking ineptitude (something they've seemingly ignored) and their most recent actions burdens brokers with further uncompromised responsibility without suitable time to prepare. You wouldn't feed a mining canary poison and then punish it because it's less effective at doing its job; this is exactly what the banks are doing to brokers.

While I wouldn't dare suggest that the banks have weaponised the code as a means of burdening brokers with legal risk, it's certainly what it looks like.