Of all the calculators you will use on your mortgage broker website, the Debt-To-Income Ratio Calculator and LVR Calculator are the easiest to use. They both accepts just two fields, and both return a relatively generic response. This article introduces an additional LVR Calculator, and a new DTI calculator tool.

The mortgage broker website we supply clients includes a comprehensive calculator archive  with around 40 calculators shipped by default - this includes a number of our own tools, and some supplied under licence to you by the MFAA or FBAA. Our broker website includes a full archive of calculators with a dedicated page for each calculator, although calculators can also be accessed via modals.

with around 40 calculators shipped by default - this includes a number of our own tools, and some supplied under licence to you by the MFAA or FBAA. Our broker website includes a full archive of calculators with a dedicated page for each calculator, although calculators can also be accessed via modals.

Calculators and SEO: While calculators are are essential component of SEO, they won't necessarily get you ranked (or at all). It's the content program you employ that generates an improved SERP, but calculators contribute towards the customer experience, so that attribute alone tends to elevate the authority of your website... but it's inline calculators, or those that are returned in content the same way you might render an image, that tends to improve the user experience which in turn impacts your broader SEO expertise and authoritativeness.

Most calculator tools we've created (until now) are designed to be rendered inline (such as the LMI Calculator, or the Limited Guarantee Calculator), and the inclusion of a calculator on the page a user is actually reading vastly improves on the authoritativeness score assigned to that page, and the calculators we're introducing are designed to support that usage.

Until now, we would generally create a 'form-style' calculator with a submit button to record results. The reason for this form-based methodology was to gain an understanding of general interactions, and it provided us with the option of applying conditional content for individual users. However, the experience is less dynamic than slider-enabled JavaScript-style calculators, so it's the latter format that'll generally be the focus of our calculator tools in the future. That said, we'll always build both styles of calculators so those that apply conditional features can continue to take advantage of advanced marketing strategies.

You require calculators on your website - it really isn't an option. Whether you call us or your industry body, it's a feature that needs to be included in your website funnels. If you're appropriately licenced to use the MFAA/FBAA calculators, you'll find calculator features and tools in our complimentary broker website plugin.

DTI Calculator

A debt-to-income ratio (DTI) is a personal finance measure that compares your debt against your aggregated income. Lenders will usually use a DTI as a means to measure their risk. Those with a lower DTI, or a lower ratio of debt measured against monthly income, are generally considered lower risk. With governance provided by APRA, they defined the DTI as 'The ratio of the credit limit of all debts held by the borrower, to the borrowers’ gross income'. This debt includes buy-now-pay-later digital services, other mortgage lending, personal loans, credit-cards, consumer finance, margin lending, Higher Education Loan Program (HELP) or Higher Education Contribution Scheme (HECS) debt, and any other debts held by the borrower (source: Reporting Standard ARS 223.0  , APRA).

, APRA).

As you know, various banks apply their own risk-based DTI criteria. For example, Commbank may flag applications with a DTI higher than 4.5, and they'll usually manually scrutinise applications higher than 7. NAB cap their DTI at 8 (which is quite high), Westpac will refer your application to credit assessors if the DTI is higher than 7, and ANZ generally won't accept applications with a DTI higher than 7.5. It's an important figure... so we need to provide a means for consumers to assess and understand these numbers.

A basic, unstyled DTI calculator is shown below. We've used the shortcode of [bm_dti].

The way in which this calculator is rendered may be an issue to some for a few reasons not the least of which is that the monthly salary is set to show a monthly limit of $40'000 - quite higher for many brokers. Every single value or line of text in the calculator may be customised. For example, the shortcode of [bm_dti max="25000" from="8000" from_debt="1700" border="3px #000000 dashed" background="#F8F8F8"] returns the following:

Available shortcode attributes are extensive, and they alter the title and subtitle text, styling, default values shown on page load, minimum and maximum values, and so on.

You will note a small check mark next to the returned DTI result will change with the returned value. Anything higher than a DTI of .4 shows amber, while anything higher than .8 returns red.

It's worth noting that we've returned two calculators to the same page. This might be useful when you're required to demonstrate different DTI variations.

When using this tool it's important that you use appropriate disclaimers, and encourage contact to understand underlying DTI confusion.

LVR Calculator

We have an existing LVR calculator, but as stated earlier, it's form-based, so the dynamic JavaScript version is usually a more user-friendly option. The icon in the LVR example changes colour based on the 80& and 95% gate, but we'll likely alter the response based on client feedback.

The shortcode attributes, and the manner in which the LVR calculator is used, is identical to the DTI calculator. Shortcode of [bm_lvrs] returns the following:

Not unlike the DTI calculator, you may choose to alter the maximum value of the purchase property. In this example, we'll apply the shortcode of [bm_lvrs max="1200000" from="750000" from_borrow="570000" border="1px dotted #3F3F3F" background="#F4FBFA"]

Again, titles and short descriptions, padding, borders, and about everything else may be modified to be consistent with your brand.

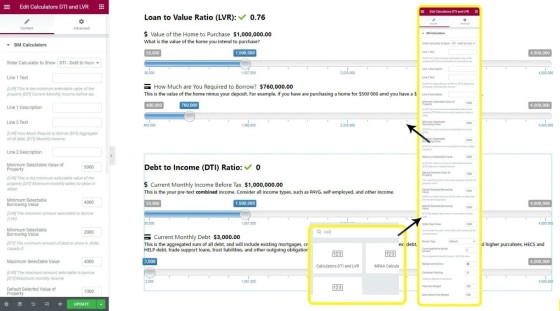

Elementor Widget

A drag-and-drop Elementor widget is made available that'll render the calculators as described. Every line of text, style, and slider value may be customised to your liking.

Pictured: Added 16th January 2023. A drag-and-drop Elementor widget is made available that'll render the DTI and LVR calculators. Every line of text, style, and slider value may be customised to your liking.

Give the commonality between calculators, the same options apply for each. A distinction between DTI and LVR values is provided with each field description.

Conclusion

These calculators are simple.,, although they're both essential (despite the fact it's taken us this long to incorporate a DTI calculator).

You'll note that the calculators are not included via iframes, which is typical of calculators in the industry. The calculators are fully integrated into your page, so all appropriate SEO authority will be assigned, and the pages will load without the lag normally associated when sourcing calculators hosted elsewhere.

We have a large number of calculators planned over coming months, so stay tuned to our various social channels. Note that an Elementor drag-and-drop widget is forthcoming.

Related Reading

If you needed more reasons to understand why our website experience outperforms everything in the mortgage market, you'll want to read about our mortgage broker website. The following articles reference various (and non-exhaustive) website calculator features.

. [ View Image ]

. [ View Image ]