Business owners rarely apply the necessary time to craft a privacy policy that ticks all the necessary compliance boxes, and when a new policy requirement is introduced by legislation (such as Best Interest Duty), those changes are rarely applied. Further, and specific to the finance industry, we've identified flaws in the required archival of privacy policies. It is the difficulty in maintaining a suite of compliance statements on your website that led us to create a simple module designed to make the compliance mandates imposed upon you less of a task (although we're guessing your privacy policy compliance isn't ever top-of-mind).

More importantly, we'll introduce a super-simple means of maintaining your website footer, comparison warning, credit guide link, and industry logos. These essential features are required by law, and they're required to be up-to-date, so we've made it very easy for you to maintain yourself (at the click of a few buttons). These features are part of Yabber  's-side management of various website features, such as your general plugins and front page content.

's-side management of various website features, such as your general plugins and front page content.

This article comes as a precursor to another that introduces our powerful Mortgage Broker Website. Designed to be extremely easy to use, and supported by the only AI-driven conditional experience in the industry, our finance website will set your marketing funnel on fire and start to deliver the organic leads that websites are meant to deliver. The funnel-centric website was designed to support our very powerful Facebook Advertising experience - the most successful in the industry.

We understand that your privacy policy isn't the most exciting topic to read about so we'll keep it short. We'll introduce the following Yabber features:

- Creating a Privacy Policy, General Disclaimer, and Terms and Conditions statement

- Setting your website footer comparison warning and general disclaimer

- Altering industry logos

One could argue that we've finally found a topic that puts people to sleep faster than cash-rate discussions.

Creating a Privacy Policy, Disclaimer, and Terms

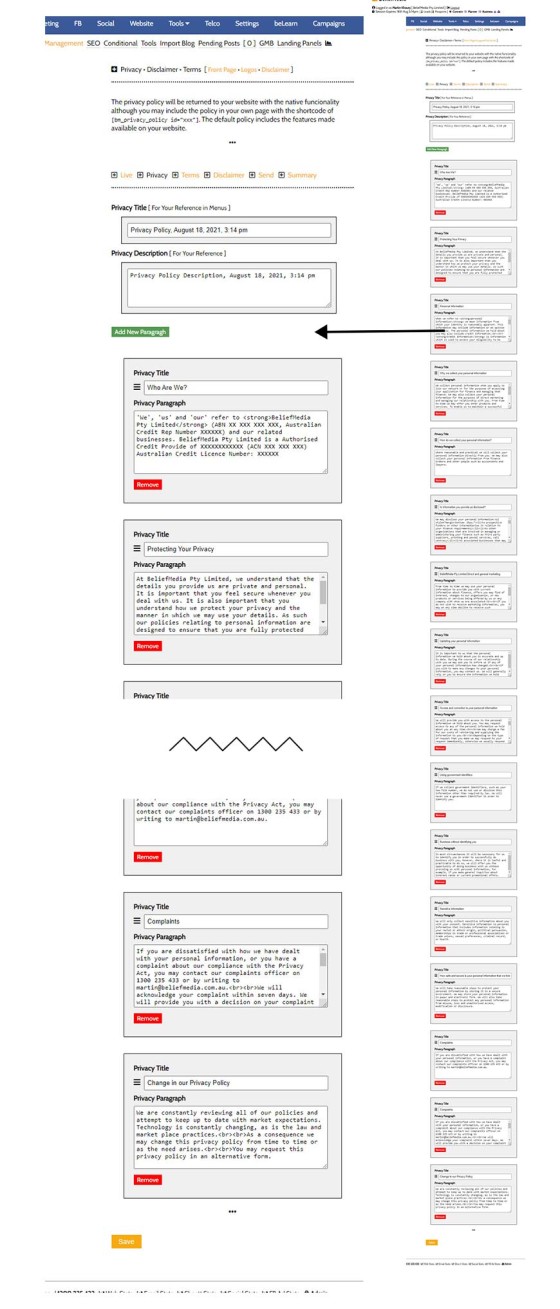

When creating any policy (privacy policy is pictured), the entry screen will populate with default data. Each paragraph is introduced as a block to make formatting and positioning easier; you simply create each section, drag-and-drop them into the correct order, and 'Save'.

Since Yabber is a multi-website system, the policy isn't created on your website until you send it with a single click (at which time the change on your website takes effect immediately).

Pictured: The creation screen shows a generic template by default (this also applies to your disclaimer and terms and conditions). You should update it as required (the first block requires your ACL details). You may create as many privacy policies that floats your boat, and any policy may be sent to any website.

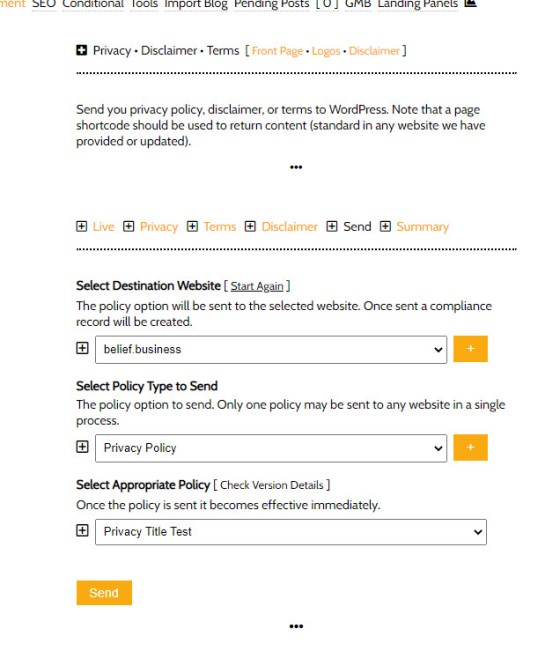

Once you're ready to send a policy to your website, you're required to select your website, the type of policy, and the policy title. Sending replaces existing data on that destination website.

The 'Last Updated' time is obviously applied by default.

For compliance purposes we archive the full text of any policy that is sent to your website. This compliance library is very important, and it's an often overlooked component of the mismanaged wild-west stuff that goes on in the finance industry.

Pictured: Sending a privacy policy, or any other policy type, to your website. The form is stepped in nature. : Aggregation and Franchises: the model for larger groups varies a little. You may choose to assign each policy to a new business, or send grouped policies directly to any number of website.

Pictured: The privacy policy link, disclaimer link, and terms of conditions link, are shown in the footer as you would expect.

Website Footer Compliance

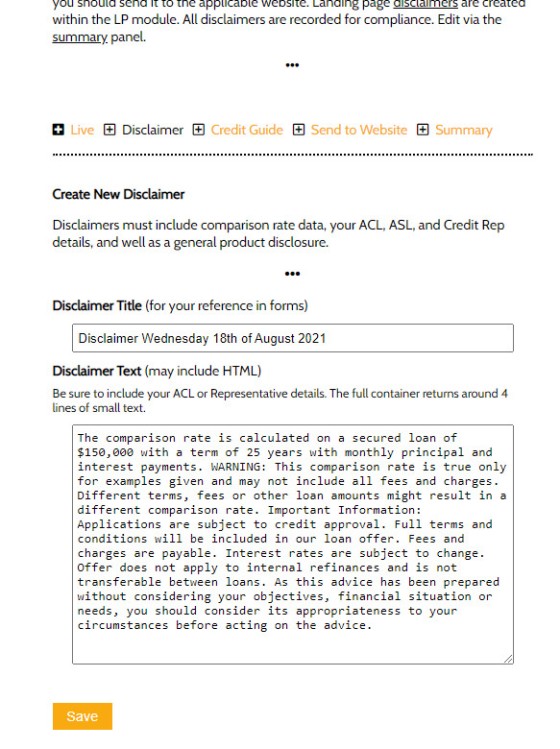

Your website requires a general footer disclaimer. The Privacy and other acts mandate that you include various types of information, such as your ACL, trading details, and a comparison warning (the latter a significant requirement since we use live and always up-to-date bank product and interest rate widgets everywhere).

Not unlike our disclaimers, we archive each and every website footer when sent to any website. This creates a full library of your consumer-facing compliance assets.

As you enter the disclaimer panel you'll find an area populated with a general disclaimer template that tends to fit the majority of requirements. Update or replace it, and click 'Save'. Once done you'll be able to effortlessly submit the data directly to your website.

Pictured: You may create any number of disclaimers, and send them to any number of websites.

Industry Logos

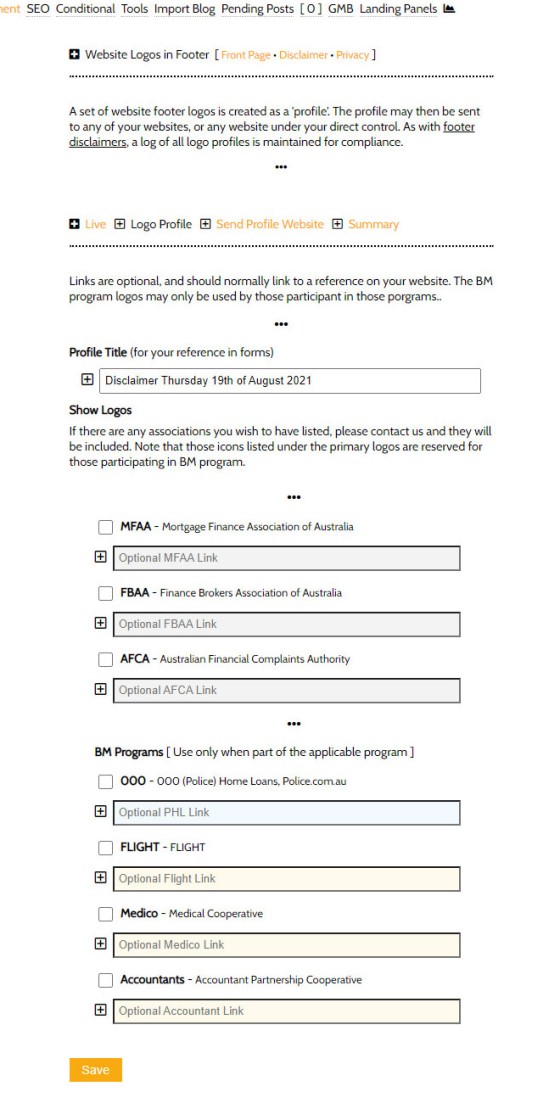

It is standard practice to include MFAA, FBAA, AFCA, and other logos into your website footer. We also run our own programs internally that generate over a billion dollars a year, and brokers will often want to show a logo on these occasions, so we've created a simple module to update logos when required (which is probably close to never). However, when the MFAA or FBAA starts to grind your gears, switching logos to alternate association is made via the click of a button.

Pictured: The primary logo panel. Note that we include a number of internal programs for participating brokers.

Logo groups are created as profiles (or groups of logos). This makes it easier for us to update managed websites, and it introduces a one-click solution to aggregators or franchises when updating multiple websites. A full archive of website logos is maintained.

An optional link may be applied to each logo, and we recommend linking to an internal page rather than the industry body (if they permit it) to keep website visitors on your website.

Pictured: The primary logo panel. Shown is the AFCA, MFAA, and FBAA logo. We're also showing our Police cooperative logo (participating and approved brokers).

Your Credit Guide

Mortgage brokers and other finance professionals are required to include a link to their Credit Guide on each page of their website. Yabber makes it easy.

Your Credit Guide is uploaded to our standard document and download manager, and then you simply assign that document to your website with the click of a button. As you replace your Credit Guide on Yabber the change will immediately be applied on your website.

The Credit Guide inheres a fully trackable link, so if a user is known to Yabber you may apply triggers (such as email, text message etc) when the guide is downloaded - an extremely powerful funnel tool.

[bm_credit_guide]your-text-here[/bm_credit_guide] returns a link wherever you want it. We know shortcode is often a pain to use so you may obviously use a standard link (tracking is still applied in a similar manner).The Credit Guide link is rendered with your standard footer 'general' disclaimer by default (pictured above).

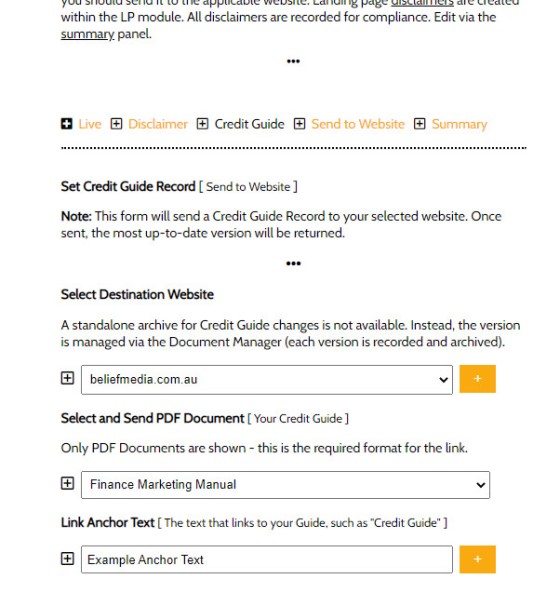

Pictured: Pictured is the panel that sends a download link to your website. Because Yabber is an integrated system you simply select the applicable PDF - no copying or pasting required. Numerous credit guide options apply, and a full log of all guides sent to all websites is maintained. The incorrectly labeled 'Anchor Text' is in fact the Alt text, with the same text also applied to the Guide tooltip.

Conclusion

This article was important before we introduce our mortgage broker website. As one of a few dozen articles introducing various website features we start to identify the massive difference between a site designed by professionals for mortgage brokers, and a static site that provides no integrated, conditional, or dynamic features. The experience we provide our mortgage brokers is unmatched anywhere in the industry.

A powerful funnel experience is predicated upon a persuasive website and broader digital experience. If you haven't optimised your website before embarking on Facebook or other campaigns you're seriously compromising on the success of those programs. Certainly, if paid representation has ever told you that a website isn't necessary (strictly true but professionally negligent) then they belong in marketing prison.

Most brokers have never known the powerful nature of an immersive funnel experience because we are the only company in the finance industry to provide a turnkey, full-stack, and fully-integrated digital experience, and the only company to provide a real marketing funnel. The messaging used to promote seriously flawed systems is professionally negligent in every respect.

The website we've referenced throughout this article is priced lower than virtually all website products in the market, and it probably provides 100X more value.