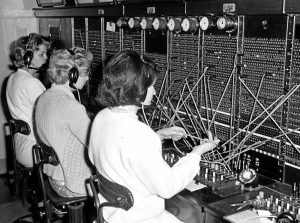

What this means is that our confidence systematically exceeds accuracy... implying we are often 'more sure' about something than we should be. In times of crisis, or simply on occasions where workload and stress is high, we often become so task-saturated that we don't have spare cognitive processing power to question our actions. This is where SOPs fit in. Regardless of task-saturation, operating procedures provides guidance and frees up cognitive power for task completion.

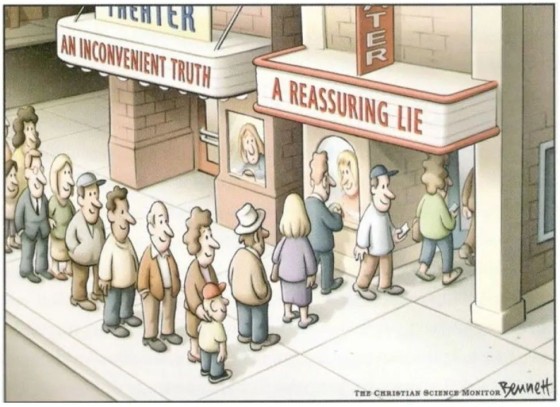

Overconfidence leads to a situation where we form an irrational escalation of commitment, or commitment bias, leading to anchoring 'tunnel vision'. The longer we vacate dynamic lateral thinking and tolerate a cognitive dissonance, the more and more we commit to a bad decision and "make the wrong decision the right decision". So, the whole "we've always done it this way" quote slowly takes on another form; "I have to do it this way because this is what works".

SOPs are an escape from the infinite loop of a commitment bias in that they will often force us to consult decision models so our personal bias' don't interfere with best-practice fact-based outcomes.

Implementing SOPs in an organisation is a genuine professional development opportunity for staff. Discussing best practice, better practice, implementation timelines, cost benefits, risks, and so on, are all means to improve upon procedures but also educate stakeholders and mitigate the risks associated with introducing change.