Built on the back of our Lender Data API, and supplementing features such as Lender Widgets, Rate Ribbons, Rate Blocks, Lender Archives, and Lender Product Pages, we've just released the Lender Document (and Media) APIs. Our Mortgage Broker Website is now shipped with an Elementor Block that'll enable the features we're about to describe.

The Lender Document API supplements the Lender Archive (and is linked to from the archive page), and it shows all the available PDF product documents associated with each of your accredited lenders. Updated every two days, the documents are grouped by product type on your website, with Residential Lending PDFs represented by a snapshot of the PDF front page, and the remaining document types are rendered as links.

Document Shortcode and Elementor Block

The purpose of the Document website tool supplements and supports the underlying objective of the hundreds of other website pages in that it qualifies you as a preferred broker by further showcasing your expertise and authoritativeness. That said, it is an unusual page that you might consider keeping hidden from standard navigation... although you'll likely reference the documentation yourself from time-to-time. The page might be suited as a funnel asset that's only revealed in email follow-up - usage is obviously entirely up to you.

An example page showing most of the lender documents can be found here (if a generic PDF cover is shown rather than a front page PDF snapshot, it means that new images are processing). Used on 'other' pages where limited information might be required, e can choose to show all documents from all lenders, or just those from selected lenders. We may also choose to include all product types, or selected product types.

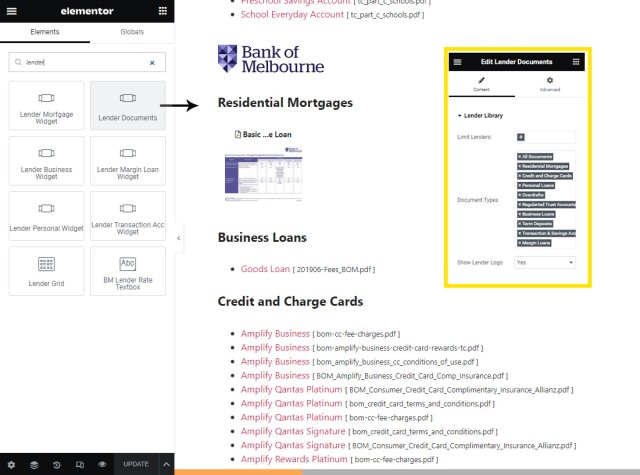

The general shortcode option introduces a complexity that is cumbersome for most, so the drag-and-drop Elementor block is a far easier method of rendering your desired result.

Pictured: Documents made available from Bendigo Bank. Each accredited lender is listed vertically occupying a large portion of the page. Documents shown (when available) include those for Residential Mortgages, Credit and Charge Cards, Personal Loans, Overdrafts, Regulated Trust Accounts, Business Loans, Term Deposits, Transaction and Savings Accounts, and Margin Loans. The Residential Mortgages documents are shown by way of a first-page image, with the remainder shown in a list. The naming convention used by lenders isn't ideal, so the document name is also printed to indicate the purpose of the document.

To render the documents on a page, you may use general WP shortcode or an Elementor block, with the latter permitting a simple drag-and-drop interface. To render the entire block of lenders with shortcode, we'd use [bm_lender_library]. To limit by lender, you should use the three-letter lender code in a comma delimited string assigned to a lenders attribute, and to limit the types of documents shown, we'd use a similar string of text assigned to a types attribute. If showing a single lender, you might choose to exclude the logo, and this may be accomplished with the attribute of logo="no". The shortcode attributes and various examples are introduced shortly.

The drag-and-drop Elementor option is far more intuitive than shortcode. Drag the 'Lender Documents' widget to a page, define your lenders (or leave for all), select the applicable document types, and you're done.

Pictured: The lender widget is dragged into any position on a page, and the applicable lenders and document types are defined within the Elementor block options. For the 'standard' library page all documents for all accredited lenders are shown. You may filter the returned documents by lender and document type, so you might include just Credit Card documents for a single lender.

Shortcode Options

Standard shortcode is most suited when rendering documents in an article (such as this one). Attributes of lenders and types are used to filter the returned data. For example, the shortcode of [bm_lender_library lenders="wbc" types="CRED_AND_CHRG_CARDS" logo="no"] returns the following (we've indented the results):

Credit and Charge Cards

- Altitude Black Rewards World Mastercard [ WBC_Consumer_Credit_Card_Comp_Insurance_Allianz.pdf ]

- Altitude Black Rewards World Mastercard [ Consumer_Conditions_of_use.pdf ]

- Altitude Business Gold Mastercard [ Altitude_Business_Conditions_Use.pdf ]

- Altitude Business Gold Mastercard [ businesscards_complimentaryinsurancepolicy.pdf ]

- Altitude Business Gold Mastercard [ Altitude_Business_Rewards_T-C.pdf ]

- Altitude Business Platinum Mastercard [ Altitude_Business_Conditions_Use.pdf ]

- Altitude Business Platinum Mastercard [ businesscards_complimentaryinsurancepolicy.pdf ]

- Altitude Business Platinum Mastercard [ Altitude_Business_Rewards_T-C.pdf ]

- Altitude Qantas Black [ WBC_Consumer_Credit_Card_Comp_Insurance_Allianz.pdf ]

- Altitude Qantas Black [ Consumer_Conditions_of_use.pdf ]

- Altitude Qantas Platinum [ WBC_Consumer_Credit_Card_Comp_Insurance_Allianz.pdf ]

- Altitude Qantas Platinum [ Consumer_Conditions_of_use.pdf ]

- Altitude Rewards Platinum [ WBC_Consumer_Credit_Card_Comp_Insurance_Allianz.pdf ]

- Altitude Rewards Platinum [ Consumer_Conditions_of_use.pdf ]

- Altitude Velocity Black [ WBC_Consumer_Credit_Card_Comp_Insurance_Allianz.pdf ]

- Altitude Velocity Black [ Consumer_Conditions_of_use.pdf ]

- Altitude Velocity Platinum [ WBC_Consumer_Credit_Card_Comp_Insurance_Allianz.pdf ]

- Altitude Velocity Platinum [ Consumer_Conditions_of_use.pdf ]

- BusinessChoice Everyday Mastercard [ businesscards_complimentaryinsurancepolicy.pdf ]

- BusinessChoice Everyday Mastercard [ 010BusinessChoiceCardsT_C.pdf ]

- BusinessChoice Rewards Platinum Mastercard [ BusinessChoiceRewardsPlatinum-Card-QantasBusTC.pdf ]

- BusinessChoice Rewards Platinum Mastercard [ 010BusinessChoiceCardsT_C.pdf ]

- BusinessChoice Rewards Platinum Mastercard [ businesscards_complimentaryinsurancepolicy.pdf ]

- Low Fee Card [ westpac-credit-card-terms-and-conditions.pdf ]

Available types are as follows: RESIDENTIAL_MORTGAGES, CRED_AND_CHRG_CARDS, PERS_LOANS, OVERDRAFTS, REGULATED_TRUST_ACCOUNTS, BUSINESS_LOANS, TERM_DEPOSITS, and TRANS_AND_SAVINGS_ACCOUNTS. and MARGIN_LOANS. The lenders (if limiting results) are included in the shortcode as a comma delimited string of three-letter bank codes (available in Yabber).

Lender Document API

Documents are available via a single endpoint: api/yabber/yabber.php. An APIKEY is required, as is the action of lender_library, and the page URL making the request. The response unwraps into an array that includes all document types attached to the lender key. Each document includes a number of fields, including a number of image URLs for the document, the original and Yabber link, filesize, and so on. It's a static response so the easiest way of exposing yourself to the format is to make a request.

API Response: Example API Data. The primary response will return a status, code, and version details, so the data is shown under the data key. All documents are shown in a product type array. Note that we return a large number of image sizes: original, large, medium, thumbnail, and small. The document linked from your website is the lender source, although a Yabber copy is maintained (and referenced in the response). If querying the Lender API, the applicable document with images is returned in the standard response.

Data is updated daily and cached on websites for up to 2 days.

Lender Media API

Lenders publish card art for authorised agents to promote their products. The quality and type of art returned by lenders doesn't follow any predictable format, and the returned image isn't necessarily any good, but it's often useful for brokers that manufacture their own promotional material.

Pictured: Example card art. The art may be of any size, and represent the product in any way. Some images show smartphone/netbank images, while others might show a card. At times you'll see a full promotional poster.

The API requests all the current images and returns them indexed on lender. The API is static in nature, and it's designed to simply allow you to synchronise your own library. Media is available via a single endpoint: api/yabber/yabber.php. An APIKEY is required, as is the action of cardart, and the page URL making the request.

API Response: Example API Data. The primary response will return a status, code, and version details, so the data is shown under the data key. The original and Yabber copy of the image is returned. If required, the other values may be used to query the parent product.

A csv parameter may be used to return a CSV format to the screen without any authentication. The entire package of images (updated daily) is available from our own demo lender archive page. The ZIP file includes all images in parent lender directories, and this is reflected in the csv file.

Lender Images and Icons: If you're after lender images and icons, you should download our free broker plugin. The images directory includes a large number of lender images in various sizes.

Both APIs described on this page function on the free API key issued with our free broker plugin.

In the Funnel

Everything we do is designed to improve your marketing efforts. The API is somewhat useless to most brokers, but the dedicated Document Page might provide value in the funnel. If everything we do is designed to qualify us, the sheer volume of information you make available further qualifies your expertise and authoritativeness in the market, and it further elevates your presence above that of your competition. There's often no more than a single link that might reference this material, so it's likely your website visitors won't be exposed to it during their early research efforts. It's high-value resources on the periphery that provides us with an opportunity to introduce additional material in our funnel, and it's in the nested funnel where we'd usually expect the page to be introduced.

Note: To support funnel escalation, the Outlook-integrated location forms we show on every page of your website will also be defined for the Document page.

Lender Data in Yabber

We're still working on an effective way in which to return all lender data in Yabber, and we expect to release the module at the same time we return the comparison engine. The module will include a basic feature that'll permit you to directly send a user any document via email.

In this first version, documents are not tracked. However, if you choose to measure and/or apply triggers to downloads, you may import any document into your Download Archive.

Related Reading

If you're interested in the suite of lender data made available on our broker website framework, the following articles will be of interest.

Our first comparison engine dates back to around 2006 when the feature effectively occupied the front page of my iChoice website. It later become a backend feature, and since I left the business it's a tool that we've only made available to our former Platinum clients. An article titled "" details… [ Learn More ]

LoanOptions.AI are an asset finance company that leverages their technology by making it available to mortgage brokers. Asset finance filter through to LoanOptions, while home loan leads are fed back to brokers. We've had a couple of our own brokers partner with the company so we built a standalone WordPress plugin to quickly enable the… [ Learn More ]

A couple of years ago we introduced a that'd return formatted rates within a style of textbox. On the back of a recent request from a client, we've created a new style of featured panel that'll return a similar lender rate textbox that is managed entirely from Yabber. While the former… [ Learn More ]

There are dozens of ways in which you may render lender data on your , and this data includes page-level archives that'll return information in an indiscriminate manner to support your funnel and educate your clients. These archives are supported by various panels and widgets that are used to showcase data of… [ Learn More ]

We archive about as much data as ASIC and other regulatory bodies or institutions make available. The API we make available to all clients by virtue of their assigned key provides access to a large number of resources and tools - most of which they'll never use. This article introduces the ASIC API in brief… [ Learn More ]

Built on the back of our Lender Data API, and supplementing features such as Lender Widgets, Rate Ribbons, Rate Blocks, Lender Archives, and Lender Product Pages, we've just released the Lender Document (and Media) APIs. Our is now shipped with an Elementor Block that'll enable the features we're about to describe.… [ Learn More ]

The we provide clients, and the associated , was built in such a way that various types of functionality was progressively drip-fed to the system. While this evolution hasn't had an impact on the user experience, it has certainly introduced superfluous code on the backend. To mitigate this… [ Learn More ]

Some time back we introduced , product , and associated product data to our . Their inclusion on your website, and when used as part of a subscription funnel of any kind, will have a tremendous impact on engagement and conversions. This article introduces a significant update to… [ Learn More ]

Some time back we introduced the that is a default component of the framework we provide clients. Supported by around a dozen different of various kinds, the archive is provided in three tiers: lenders, lender parent products, and lender product pages, with the latter providing… [ Learn More ]

There's a very good reason we encourage bank rate and product data to be shown everywhere on your website - it converts. Like it or not, most consumers are motivated by rate but sold on structure, so the rate plays an important part in establishing various funnel pathways on your and broader

This article introduces the 'entry-level' website we provide mortgage brokers. As we'll come to explain, and despite calling it an 'entry-level' website, it's not only the most affordable and powerful website made available to small and medium businesses, it's also the only website in the industry that is driven by automation and AI, and we… [ Learn More ]

We've introduced numerous live and always up-to-date bank rate features on numerous occasions in the past. We take the approach that bank rate data and product information is vital for a persuasive and powerful website and funnel experience, so we plaster the information wherever we can squeeze it, and whenever it's contextually relevant. This article… [ Learn More ]

This article supports an introduction to our , and provides some context to understand the website's purpose, and how integrates with your website to provide a leading online presence. The majority of brokers we deal with are drawn to , and this article starts to expose those reasons… [ Learn More ]

In previous articles we've introduced a number of ways in which we return live and always up-to-date bank related data into your . The most notable, or at least the most popular feature, is the drag-and-drop live that renders defined product types into a tidy and fully customisable… [ Learn More ]

Until recently, our high-performing included a linear one-row slider of banks to showcase your accredited panel. It wasn't until a brilliant broker in Western Sydney asked for a large image showing all accredited banks that we started to consider how the evolved feature might be used as a conversion element, and… [ Learn More ]

If you provide a dynamic website experience filled with relevant information, resources, education, and guidance, you will inevitably draw far more traffic into your and marketing funnels, and ultimately more active clients into your Opportunity pipeline. When you have a digital program of any kind (even if it's just a

A short time ago we made a complimentary website plugin available that would and return applicable data. Used on your website it's just another tool that'll attract, engage, and convert your audience. Since nobody else provides the feature it's one that will likely set you apart from the sea of… [ Learn More ]

A comparison rate is the true cost of a loan every year, which including fees and charges, and is generally considered a more realistic comparative figure than the published interest rate assign to a mortgage product. While an interest rate may be advertised as low to lure you into that product, the comparison rate generally… [ Learn More ]

We talk all the time about how and why the default converts far higher than other websites in the market, and how our conversion-optimised website is integral to your marketing funnel, and this article introduces you to one of our more powerful website features that literally changes the digital… [ Learn More ]

This article introduces a single component of broad data integration with . In the first of many articles that deal with integrating real-time Australian banking data and information pages into your website, we'll show you how to include a single product panel in any post or page with real-time interest rate… [ Learn More ]

The Currency exchange rate API is one of about a hundred finance-related API's we make available to clients via . Government sourced, updated daily, and dating back to 1983, the RESTful Exchange API returns the exchange rate for a number of currencies compared against the Australian dollar. Useful as a standalone tool - or… [ Learn More ]

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, also known as the Banking Royal Commission and the Hayne Royal Commission, was established on the 14th December 2017 to investigate and report on misconduct in the banking, superannuation, and financial services industry. The commission uncovered its fair share of banking malfeasance… [ Learn More ]

Conclusion

Despite the fact that we've archived this data for years, the inclusion of this module came off the tail end of a discussion with our legal representation. Their interpretation of Best Interest Duty was such that full disclosure of product terms and conditions meant making that information available when it was made available to us. Making the data available is an extremely high-value marketing and website resource, but it also provides another compliance tick... despite the fact excluding it would never expose us to regulatory scrutiny.

With a recent hiccup we experienced with our servers, we're progressively moving through each client website to ensure various features weren't impacted. As part of that process, we'll add the Lender Library page... although we won't link it from anywhere unless it's specifically requested.