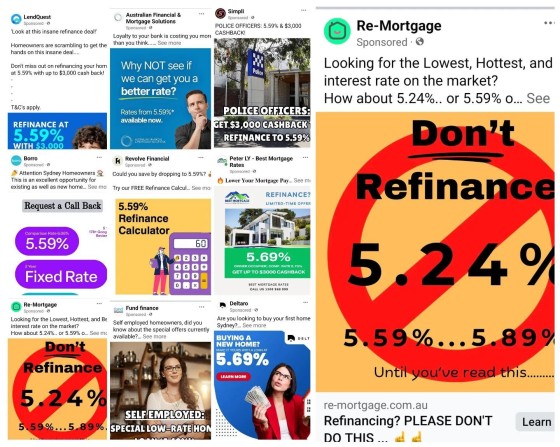

Far too many legitimate businesses are exposing themselves to a litigious future, and excluding a comparison rate is the most obvious obligation imposed on our ads. If I were to consider quantitative claims, about every broker advert currently showing is illegal.... yet aggregation/ACL holders do nothing. I just don't get it.

I've just published an article on a group called 'Broker Grow' showing some of the most egregious infractions I've ever seen (no relationship to our 'Broker Growth' program in any way). The article was necessary so brokers knew we had nothing to do with the lower-performing product.

To recap.

RG178.23

"An advertised comparison rate must be identified as a comparison rate and the comparison rate must not be less prominent in an advertisement than any interest rate or the amount of any repayment stated in the advertisement: s164, National Credit Code.

We [ASIC] consider that the following examples would result in the comparison rate being less prominent than the advertised interest rate:

(a) a comparison rate is smaller in size or faded in colour when compared to the interest rate; or

(b) an interest rate is published online and a consumer is required to click through or additionally do something (such as move their cursor over the interest rate) to view the comparison rate; or

(c) the displayed comparison rate is not in close proximity to the displayed interest rate."

RG178/RG234.156

"It is not necessary to show that consumers have actually been misled - the law prohibits conduct that is *likely* to mislead.

Consumers cannot be expected to study or revisit an advertisement - the most important consideration is the overall impression created by the advertisement when viewed for the first time.

Silence can be misleading or deceptive when it is reasonable for a consumer to expect disclosure of important information - silence on important details can render a statement misleading, even though it is factually correct."

It's not hard to be compliant.