We looked at this experience in the past, although a former client of theirs had a customer make a formal complaint, so it's worth revisiting.

Created by a mob called 'MakesCents' (EMBR Group), the subscription funnel breaks a few big-ticket laws that will land your in a world of hurt. Of course, it's a ridiculously poor product that is less effective than the plugin we give away for free.

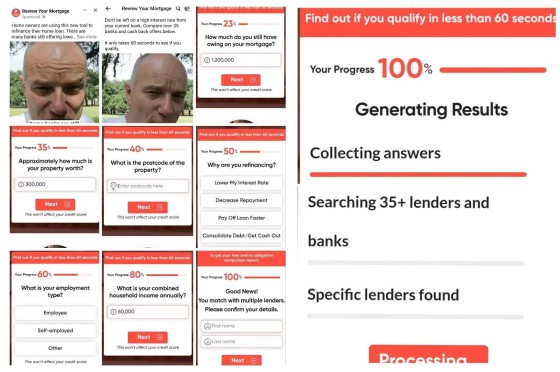

The experience from this mob is typical. They'll ask a bunch of questions that are largely irrelevant in order to make it easier to sell leads, and they'll scare off legitimate (and higher-value) customers with multiple form panels (every 'next' panel in a form objectively decreases conversions). The type of questions asked were borderline ridiculous.

The form claims to 'qualify' a user, but it returns a 'Success' message regardless of the values provided - we tried multiple combinations. In other words, the form is used to make it easy to sell leads - a client is surrendering private data under the pretence of 'qualification' when the results are fixed and totally fictitious. Think about how this lie sits with Best Interest Duty, and think of the laws you're violating and supporting with that action alone. There was a time in this industry where baiting, deception, lies, and deliberate privacy violations would be frowned upon.

One of the more troubling aspects of ads like this are that they fake a check of lenders (the code in the background reveals that the 'checking' animation does absolutely nothing). It's a lie. It's baiting. It's non-compliant. It's illegal. It's just a disguising practice.

The term 'qualify', used in the finance setting, with a user expectation that engagement will genuinely assess borrowing, is clearly illegal.

There are *still* brokers that willingly invite this style of illegal advertising into their operation.